This story is part of CNBC Make It’s Millennial Money series, which profiles people around the world and details how they earn, spend and save their money.

Sitting in her immaculately organized bedroom, Bukola Ayodele recalls some of the challenges she’s faced as a black woman in tech. She doesn’t work with many people who look like her, she says, which can feel isolating. Occasionally, the security team in the office building where she’s worked for three years will stop her in the lobby, not believing she belongs there until she shows her badge.

But Ayodele tells CNBC Make It that she isn’t deterred by these obstacles. Her parents encouraged her to pursue a well-paying profession, and Ayodele makes over $200,000 a year as a software engineer. She works hard to save and invest smartly.

Now, she wants to inspire more women, and especially black women, to join her in tech.

The statistics make it obvious why this is an important goal for her: While women of color comprise 39% of the female-identified population in the U.S., according to a 2018 report from the Kapor Center, Pivotal Ventures and Arizona State University’s Center for Gender Equity in Science and Technology, they earn less than 10% of all computing bachelor’s degrees.

More startling: Less than 2% of workers at 177 Silicon Valley firms are women of color, the same report found.

Ayodele attributes that low percentage, partly, to being unaware of the opportunities available. To help fill the gap, she started a YouTube channel called The Come Up to provide black women and other women of color with the resources and advice she wished existed when she first considered pursuing a career in tech.

“It’s mostly white men who are software engineers, but I don’t think you should let that stop you,” Ayodele tells CNBC Make It. “The more black women in tech, the better.”

Lately, she’s also been adding financially focused videos to the channel, including, “How to prepare for the next market crash” and “How to budget monthly for beginners.” She hasn’t made money off of her YouTube channel yet, but plans to start monetizing it in 2020.

What she earns

Ayodele earns around $210,000 pre-tax annually as a software engineer at an analytics company, including her base salary, bonus and equity. She doesn’t touch the equity and lives off of her base salary and bonus.

Her parents placed a premium on education and it was expected that she would pursue a professional career. Born in Nigeria, she immigrated to America with her parents and sister when she was six. Her family worked hard to build a new life in the U.S., her mother as a middle school teacher, and her father first as an accountant and later as a school administrator.

She attended Columbia University where she studied political science. She graduated in 2016 with $7,000 in student loan debt, thanks to combination of needs-based financial aid and holding a job throughout college, as well as financial support from her grandmother and her parents, who also took out some loans. She paid off her loans by the beginning of 2018.

Growing up, “we had a saying that you could either be a doctor or a lawyer or a disgrace,” she says, and after college, she expected to go into law. But it didn’t take her long to realize she wasn’t passionate about the work.

Computer science, though, had appealed to her since she took an introductory course in undergrad. After researching careers online, Ayodele quit her job in compliance in 2017 to attend a three-month engineering retreat at the New York City-based RECURSE Center to refresh her programming skills.

Leaving behind a steady job is never an easy call, especially when you’re living paycheck to paycheck, like Ayodele was. While the retreat itself was free, she saved around $6,000 in the months before she quit her job. Making that career change is what inspired her to start taking her finances more seriously: She watched YouTube videos, listened to podcasts and cut her expenses down as far as she could to save up.

“When I wanted to leave my job, I had basically nothing in my bank account,” she says. “And I just realized that, wow, not having savings really limited me, because I couldn’t take the risks that I wanted to take.”

It was a bit of a gamble quitting her full-time job to pursue a career in computer science, but she considered it an investment in her future, and it turned out to be a pretty good call: Ayodele says her old salary was about a quarter of what she earns now. She’s not living paycheck to paycheck anymore.

“My parents told me that I was making a huge mistake and that I shouldn’t do this at all,” she says. “But I decided that this is my life, my decisions.

“They’re not as mad anymore, to be honest,” she says with a laugh.

How she budgets

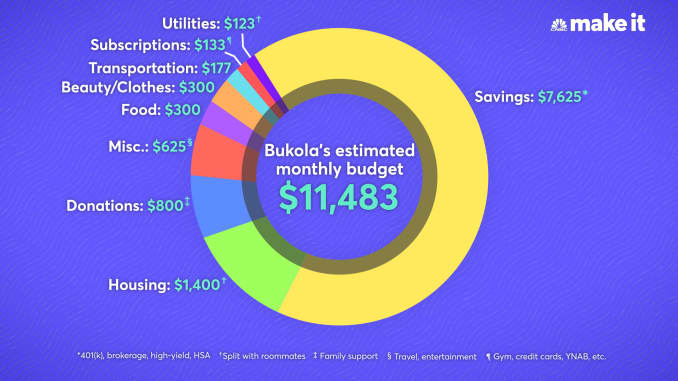

Here’s a breakdown of Ayodele’s typical monthly budget as of January 2020. She uses You Need a Budget to keep track of her spending, and Personal Capital as a way to measure her net worth and long-term goals.

“I’m actually obsessed with tracking things, I track my calories, I track my workouts and I also track my money,” she says. “I believe in this philosophy of what doesn’t get measured, doesn’t get managed.”

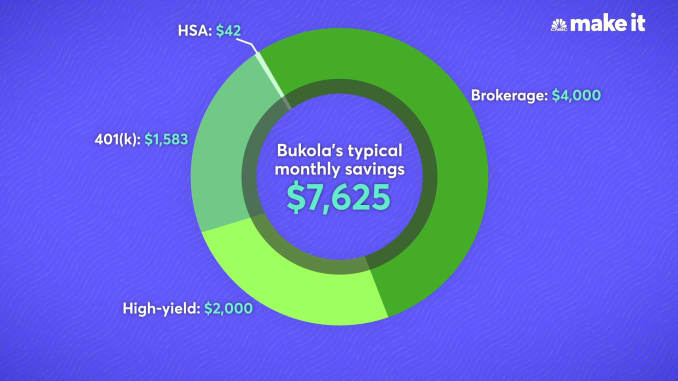

Investments: $5,625

Ayodele is a fan of the FIRE — financial independence, retire early — movement, and one of her goals is to earn enough off of her investments that all of her monthly costs are covered.

To that end, she contributes $1,583 each month to max out her 401(k) contributions for the year (those were her contributions in 2019 when this story was reported; the 2020 individual contribution limit increased slightly from $19,000 to $19,500), and invests an additional $4,000 a month in a Vanguard brokerage account. She also contributes around $42 a month to a health savings account.

Savings: $2,000

She also tries to keep her savings rate high. Though it varies each month, she typically stashes around $2,000 in a Capital One 360 account. Eventually, she plans to use this money to buy an apartment in the city. Even on a high salary, Ayodele’s savings habits are impressive, which she attributes to the lessons she learned from her mom and dad.

“My parents came here in their thirties, and they were very frugal,” she says. “Part of the reason why I save so much comes from what I’ve learned from my parents.”

Housing: $1,400

Total rent for a three-bedroom apartment Ayodele shares with her sister and another roommate in the Prospect Heights neighborhood of Brooklyn totals $4,000 a month. Ayodele pays $1,400.

“This is actually the most I’ve ever spent on rent,” she says. “I was a little mad to spend this much, but the area is really nice. And it’s even closer to work, so I save time in my commute. I actually really love living here.”

Family support and charitable donations: $800

She helps support her younger sister, who graduated from college last year, and gives money to her parents to repay them for taking out loans for her college education. “It’s the least I can do for what they’ve done for me,” she says.

She also gives around $50 per month to Black Girls Code, and occasionally to other organizations or GoFundMe campaigns.

“I’m a black girl who codes, and I think the organization is doing really great stuff to get more black women into technology,” she says.

Travel and entertainment: $625

Her family didn’t travel much when Ayodele was a child (“We only went to the library — that was our vacation”), so now it’s something she prioritizes. She and her boyfriend, who lives in Los Angeles, take an international trip each year; so far, they’ve been to Mexico City, South Africa and around Europe. She also regularly makes cross-country trips to see him.

“I learn so much whenever I travel,” she says. “It’s a lot of fun.”

Beauty and clothes: $300

“I really love spending money on beauty,” she says. “It’s the way I express myself.”

Ayodele likes trying out new makeup, getting her nails done and sugaring, a hair removal treatment

Other expenses:

- Food: $300 ($200 toward groceries and $100 for dining out)

- Transportation: $177 for an unlimited subway card and the occasional Uber ride

- Utilities: $123 for her share

- Subscriptions/memberships: $133 for personal training, credit card fees and a few other expenses

What the expert says

CNBC Make It spoke to Zaneilia Harris, a certified financial planner and president of Harris and Harris Wealth Management Group, to get her thoughts on what Ayodele is doing right with her money and where she could improve.

Going in the right direction

Overall, Harris says Ayodele has impressive finances, especially for someone so young. “I mean wow,” says Harris. “She is very wise when it comes to how she handles her money.”

Some of the best things Ayodele is doing include maxing out her 401(k) and investing so aggressively, Harris says. And even though she could easily afford her own place, Ayodele is being smart by mitigating the high cost of living in NYC by having roommates.

“I feel she has discovered that balance is key when it comes to managing her money,” says Harris. “I love that Bukola has put herself first.”

Still, there are a few things Ayodele could do to put herself in an even better spot.

Increase HSA contributions

Right now, Ayodele is contributing just over $40 a month to a health savings account. But given her income, she could contribute more to set herself up for medical costs down the line and take full advantage of the account’s tax advantages: Contributions are tax-deductible, and gains and withdrawals are not taxed when used for qualified medical expenses.

Plan for the future

There are two things Ayodele should do now to protect her future: Consider purchasing disability insurance, and put an estate plan in place.

Sure, it’s morbid, but with the number of assets Ayodele has already accumulated, it should be a top priority to ensure they are dispersed how she wants them to be, should something happen.

If her job doesn’t offer disability insurance, Harris says, she can buy it outside of work to protect any potential lost wages. She can set up an estate plan through an attorney, and set up transfer-on-death agreements for her checking, savings and investment accounts on her own.

Consider a Roth 401(k)

Unlike a Roth IRA, there’s no income eligibility limit on a Roth 401(k). Harris says Ayodele should consider splitting her 401(k) investments between the two types of accounts if her workplace offers it.

“This will allow her to diversify the types of retirement accounts she owns and how her withdrawals will be taxed in the future,” says Harris.

That tax diversification will give Ayodele more flexibility as she gets older.

“I see money basically as a tool to buy you more freedom, to give you more options,” says Ayodele. “Part of the reason I try to work as hard as I can is so I can also give myself and my family those opportunities.”

You can check out the latest casting calls and Entertainment News by clicking: Click Here

Click the logo below to go to the Home Page of the Website

Click the logo below to follow ETInside on Twitter

Click the logo below to follow ETInside on Facebook

Click the logo below to follow ETInside on Instagram

Click the logo below to follow ETInside on Pinterest

Click the logo below to follow ETInside on Medium